Tax Receipts For Charitable Donations . a donation receipt is a document issued by a 501 (c) (3) organization to a donor to acknowledge their charitable contribution. the irs requires nonprofit donation receipts when a donor makes a charitable contribution of $250 or more. the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain. in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized. keep track of all your taxable donations and itemize them on schedule a (form 1040). a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a. A tax receipt, on the other hand, is a document issued by the irs to the taxpayer as proof of their tax payment or refund.

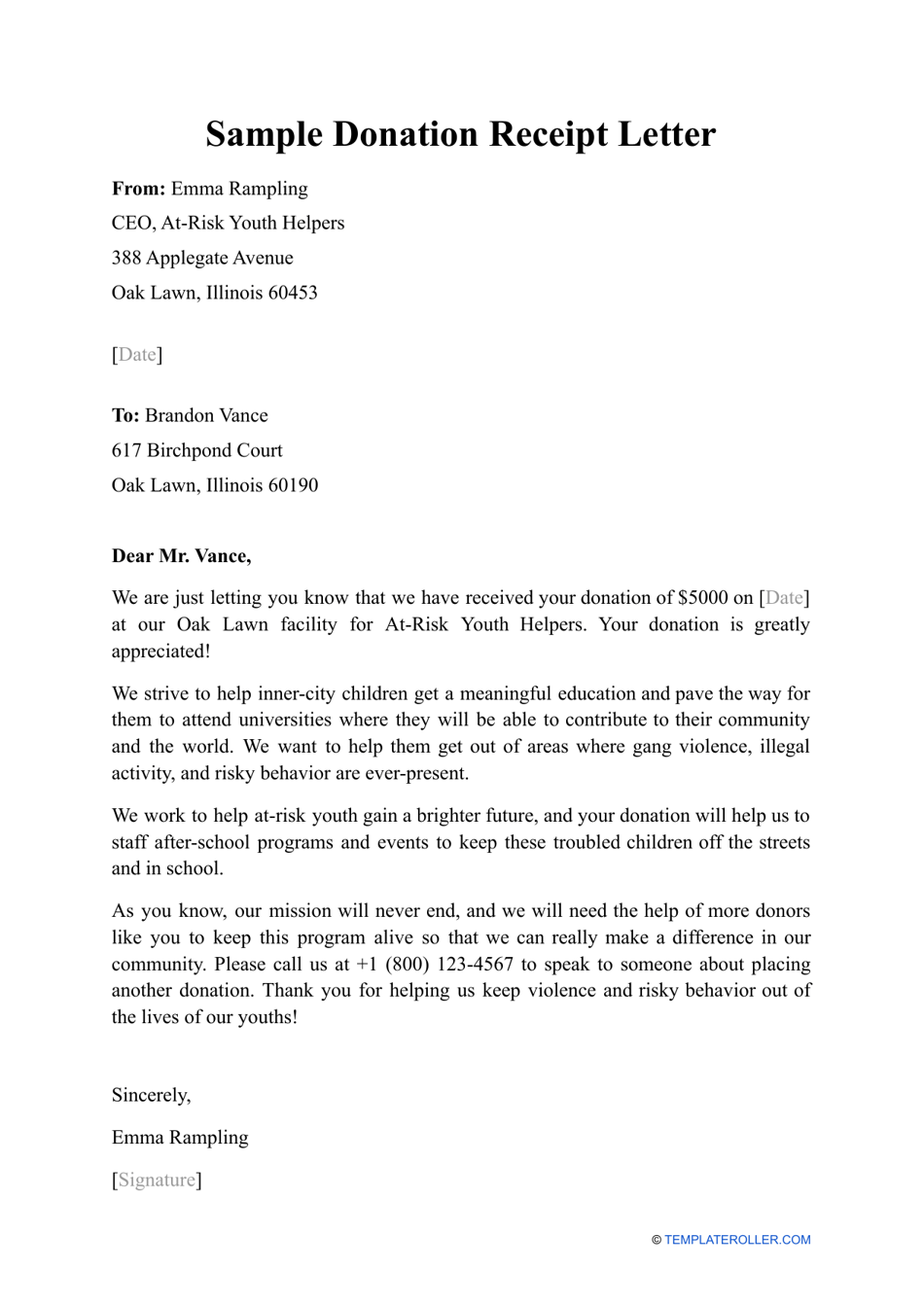

from www.templateroller.com

a donation receipt is a document issued by a 501 (c) (3) organization to a donor to acknowledge their charitable contribution. A tax receipt, on the other hand, is a document issued by the irs to the taxpayer as proof of their tax payment or refund. in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized. the irs requires nonprofit donation receipts when a donor makes a charitable contribution of $250 or more. the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain. a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a. keep track of all your taxable donations and itemize them on schedule a (form 1040).

Sample Donation Receipt Letter Download Printable PDF Templateroller

Tax Receipts For Charitable Donations a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a. a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a. a donation receipt is a document issued by a 501 (c) (3) organization to a donor to acknowledge their charitable contribution. in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized. A tax receipt, on the other hand, is a document issued by the irs to the taxpayer as proof of their tax payment or refund. the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain. the irs requires nonprofit donation receipts when a donor makes a charitable contribution of $250 or more. keep track of all your taxable donations and itemize them on schedule a (form 1040).

From www.etsy.com

501c3 Donation Receipt ,501c3 Donation Receipt Template , 501c3 Tax Receipts For Charitable Donations keep track of all your taxable donations and itemize them on schedule a (form 1040). in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized. the irs requires nonprofit donation receipts when a donor makes a charitable contribution of $250 or more. A tax receipt, on the other hand,. Tax Receipts For Charitable Donations.

From aashe.net

Charitable Donation Receipt Template FREE DOWNLOAD Aashe Tax Receipts For Charitable Donations in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized. the irs requires nonprofit donation receipts when a donor makes a charitable contribution of $250 or more. keep track of all your taxable donations and itemize them on schedule a (form 1040). a 501(c)(3) donation receipt is required. Tax Receipts For Charitable Donations.

From www.template.net

Donation Receipt Template in Microsoft Word Tax Receipts For Charitable Donations the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain. a donation receipt is a document issued by a 501 (c) (3) organization to a donor to acknowledge their charitable contribution. in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized. A tax receipt,. Tax Receipts For Charitable Donations.

From www.sampleforms.com

FREE 5+ Donation Receipt Forms in PDF MS Word Tax Receipts For Charitable Donations the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain. the irs requires nonprofit donation receipts when a donor makes a charitable contribution of $250 or more. keep track of all your taxable donations and itemize them on schedule a (form 1040). A tax receipt, on the other hand, is a document. Tax Receipts For Charitable Donations.

From www.sampletemplates.com

FREE 36+ Printable Receipt Forms in PDF MS Word Tax Receipts For Charitable Donations a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a. A tax receipt, on the other hand, is a document issued by the irs to the taxpayer as proof of their tax payment or refund. in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as. Tax Receipts For Charitable Donations.

From www.wordtemplatesonline.net

46 Free Donation Receipt Templates (501c3, NonProfit) Tax Receipts For Charitable Donations a donation receipt is a document issued by a 501 (c) (3) organization to a donor to acknowledge their charitable contribution. A tax receipt, on the other hand, is a document issued by the irs to the taxpayer as proof of their tax payment or refund. in most cases, the amount of charitable cash contributions taxpayers can deduct. Tax Receipts For Charitable Donations.

From www.freesampletemplates.com

5 Charitable Donation Receipt Templates Free Sample Templates Tax Receipts For Charitable Donations keep track of all your taxable donations and itemize them on schedule a (form 1040). a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a. A tax receipt, on the other hand, is a document issued by the irs to the taxpayer as proof of their tax payment or refund. . Tax Receipts For Charitable Donations.

From www.sampletemplates.com

FREE 20+ Donation Receipt Templates in PDF Google Docs Google Tax Receipts For Charitable Donations a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a. A tax receipt, on the other hand, is a document issued by the irs to the taxpayer as proof of their tax payment or refund. the irs requires nonprofit donation receipts when a donor makes a charitable contribution of $250 or. Tax Receipts For Charitable Donations.

From learn.acendia.com

Ultimate Guide to the Donation Receipt 7 MustHaves & 6 Templates Tax Receipts For Charitable Donations the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain. A tax receipt, on the other hand, is a document issued by the irs to the taxpayer as proof of their tax payment or refund. in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized.. Tax Receipts For Charitable Donations.

From sampletemplates.com

10 Donation Receipt Templates Free Samples, Examples & Format Tax Receipts For Charitable Donations a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a. A tax receipt, on the other hand, is a document issued by the irs to the taxpayer as proof of their tax payment or refund. a donation receipt is a document issued by a 501 (c) (3) organization to a donor. Tax Receipts For Charitable Donations.

From bestlettertemplate.com

Free Sample Printable Donation Receipt Template Form Tax Receipts For Charitable Donations a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a. the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain. A tax receipt, on the other hand, is a document issued by the irs to the taxpayer as proof of their tax payment or refund. . Tax Receipts For Charitable Donations.

From www.availcpa.com

The basics of issuing charitable donation receipts Tax Receipts For Charitable Donations in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized. the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain. a donation receipt is a document issued by a 501 (c) (3) organization to a donor to acknowledge their charitable contribution. the irs. Tax Receipts For Charitable Donations.

From www.sampletemplatess.com

6 Tax Donation Receipt Template SampleTemplatess SampleTemplatess Tax Receipts For Charitable Donations the irs requires nonprofit donation receipts when a donor makes a charitable contribution of $250 or more. A tax receipt, on the other hand, is a document issued by the irs to the taxpayer as proof of their tax payment or refund. the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain. . Tax Receipts For Charitable Donations.

From nizam.letmeget.net

Original Template Charitable Donation Receipt Latest Printable Tax Receipts For Charitable Donations keep track of all your taxable donations and itemize them on schedule a (form 1040). a donation receipt is a document issued by a 501 (c) (3) organization to a donor to acknowledge their charitable contribution. in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized. the irs. Tax Receipts For Charitable Donations.

From eforms.com

Free Goodwill Donation Receipt Template PDF eForms Tax Receipts For Charitable Donations A tax receipt, on the other hand, is a document issued by the irs to the taxpayer as proof of their tax payment or refund. keep track of all your taxable donations and itemize them on schedule a (form 1040). the irs requires nonprofit donation receipts when a donor makes a charitable contribution of $250 or more. . Tax Receipts For Charitable Donations.

From www.sampleformats.org

Donation Receipt Templates 17+ Free Printable Excel, Word & PDF Tax Receipts For Charitable Donations keep track of all your taxable donations and itemize them on schedule a (form 1040). the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain. A tax receipt, on the other hand, is a document issued by the irs to the taxpayer as proof of their tax payment or refund. the irs. Tax Receipts For Charitable Donations.

From goodwillnne.org

How to fill out a Goodwill Donation Tax Receipt Goodwill NNE Tax Receipts For Charitable Donations a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a. a donation receipt is a document issued by a 501 (c) (3) organization to a donor to acknowledge their charitable contribution. keep track of all your taxable donations and itemize them on schedule a (form 1040). A tax receipt, on. Tax Receipts For Charitable Donations.

From www.allbusinesstemplates.com

Charitable Donation Receipt Templates at Tax Receipts For Charitable Donations a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a. a donation receipt is a document issued by a 501 (c) (3) organization to a donor to acknowledge their charitable contribution. keep track of all your taxable donations and itemize them on schedule a (form 1040). the written acknowledgment. Tax Receipts For Charitable Donations.